Curriculum

MACC program curriculum

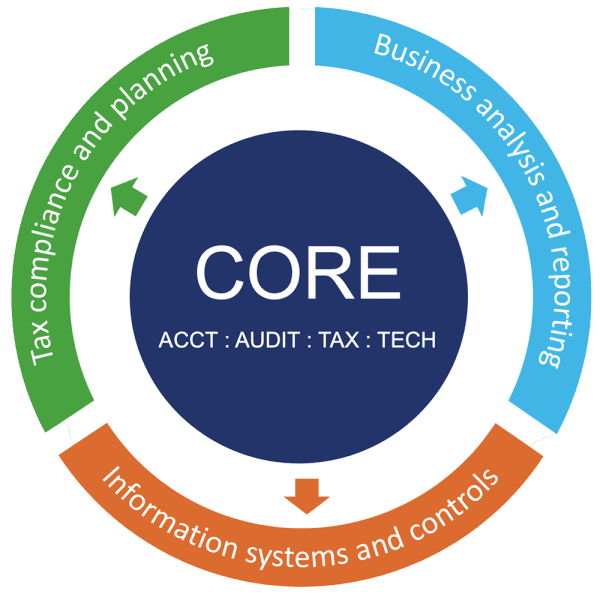

The MACC program curriculum consists of 30 credit hours (10 classes) of graduate coursework. The coursework is divided into three components: required classes, elective classes and a capstone class.

Our program is designed to help students pass the CPA Exam. The CPA Exam consists of three core sections in Auditing and Attestation, Financial Accounting and Reporting and Taxation and Regulation. In addition, each exam candidate will also take a discipline exam, which will focus on either:

- Information Systems and Controls

- Tax Compliance and Planning

- Business Analysis and Reporting

Our elective options align to disciplines and students can focus in any discipline, as preferred.

Plan of Study*

Fall

- Business Tax I (required)

- Financial Statement Auditing (required)

- Advanced Financial Reporting & Analysis I (required)

- Accounting Data Analytics (required)

Spring

- Discipline-Focused Elective (required)

- Capstone Class (required): Tax Strategy and Policy or Accounting Research and Communications

- Elective 1

- Elective 2

Summer

- Elective 3

- Elective 4

Admission, progression requirements and all program requirements can be found in the Graduate Catalog.

* This plan is based on full time enrollment for one year.